REMITTANCE

send money safelyForeigncy’s payout partner are highly reputable commercial banks and remittance house

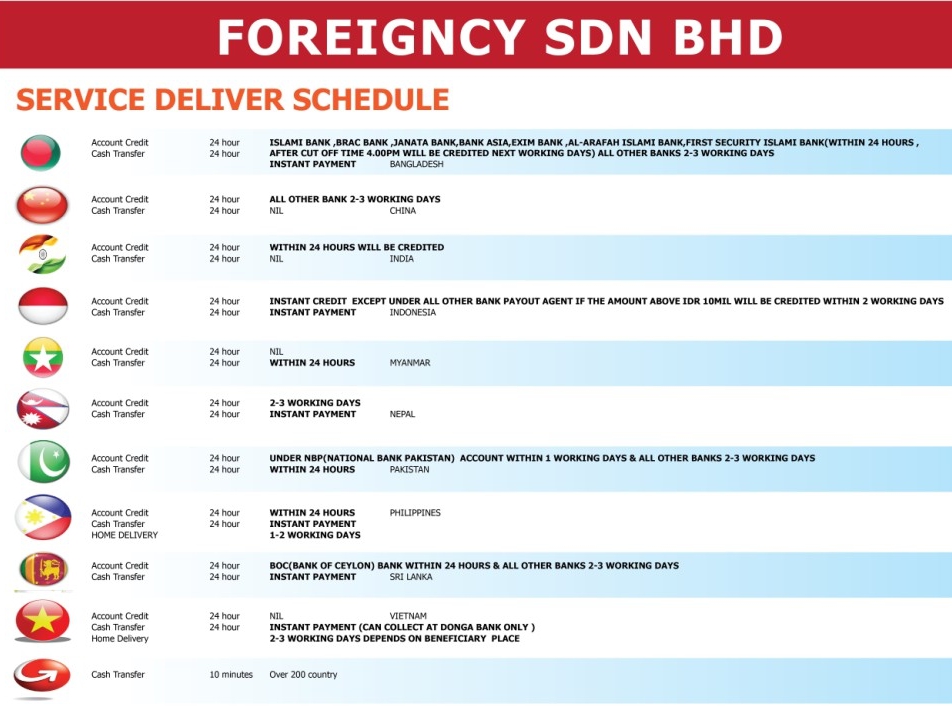

Remittance Services

The remittance is regulated under the Exchange Control Act 1953 and the Payment Systems Act 2003.

Specific legislation to regulate the money-changing, that is the Money-Changing Act 1998, was enacted in March 1998. Both businesses are regulated by BNM.

In addition to licensed money-changers which provide retail money changing services, Bank Negara Malaysia also regulates currency wholesalers.

The main objective of regulation is to promote the protection of consumers though reliable, transparent and professional conduct in the provision of remittance and money-changing services, and preventing the industry from being used as a conduct for money laundering and terrorist financing.

In 2009, Bank Negara Malaysia initiated a review of the legal and regulatory framework for the money changing, remittance services and wholesale currency business in Malaysia, with the objective of modernizing the landscape, and strengthening safeguards to protect the integrity of the business.

The review culminated in the passing of the Money Services Business Act 2011 (MSB) in July 2011 which provides for the licensing, regulation and supervision of money changing, remittances and wholesale currency business under a single Act. Collectively, these businesses are described as money services business in the new landscape.

B2B Remittance

B2B remittance only offer to Corporate Money Changing Service existing client who have the rapport with Foreigncy Sdn Bhd. The limit of the remittance RM 250,000.00 per transaction.

What is WESTERN UNION (WU)?

WU is the service offer by WESTERN UNION as which remit money sent out from Malaysia to another country. While the WU remit back to Malaysia from another country back to Malaysia. For individual outward remittance amount are limit maximum RM 50,000.00 per transaction/day.

AGENT FOR

ASSOCIATE MEMBER